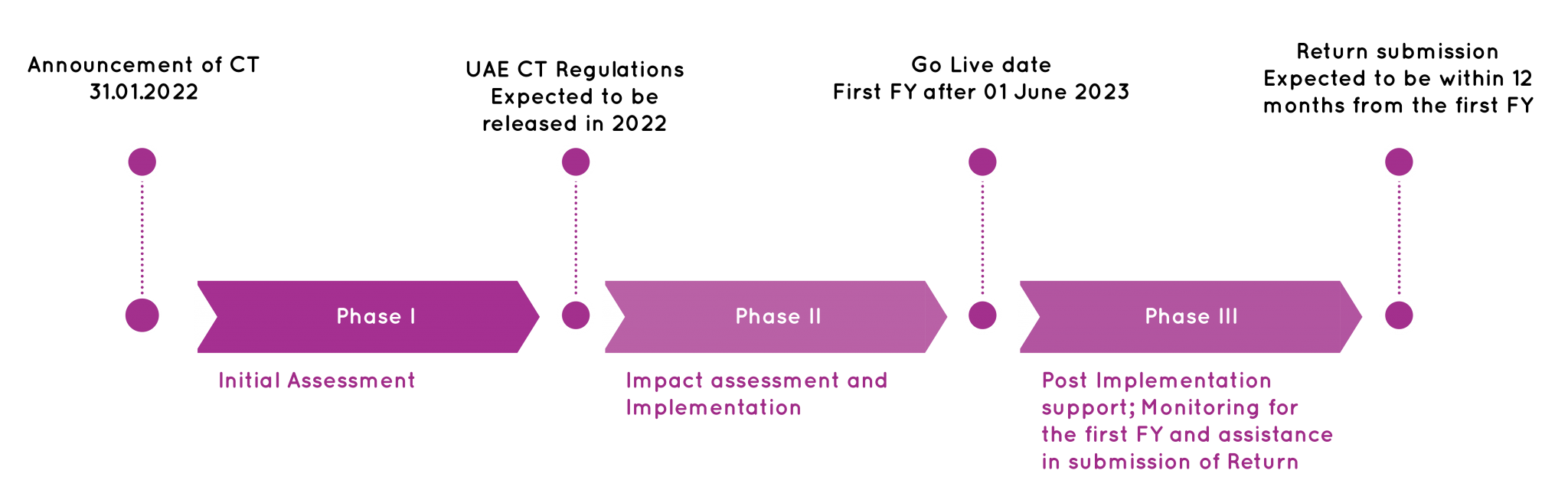

While regulations are yet to be released, our tax experts will assist you in reviewing your current business lines and flag the potential impact based on the information available. We can also highlight key pointers you should study when regulations are available.

Corporate Tax Services in UAE

PHASE 1 – PRELIMINARY ANALYSIS

PHASE 2 – IMPACT ANALYSIS AND IMPLEMENTATION SERVICES

Post-release of the regulations, our tax experts can help you assess the impact of regulations on your business and re-confirm our findings from our initial assessment. Detailed analysis of regulations to provide Tax optimization techniques and strategy for implementation. Our Finance and Tax experts can help you adapt or implement accounting systems, policies, and procedures required to Go-live.

PHASE 3 – CORPORATE TAX COMPLIANCE

Our Finance and Tax experts can work closely with your internal finance team to review your books of accounts on a periodical basis and ensure the application of the suggested strategy, policies, and procedures. Our team will also be able to assist you in assessing the tax payable and submitting returns to the authority.